2022 tax brackets

Tax brackets and rates for the 2022 tax year as well as for 2020 and previous years are elsewhere on this page. The 2022 tax brackets affect the taxes that will be filed in 2023.

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

Up from 20550 in 2022.

. The income brackets though are adjusted slightly for inflation. Get help understanding 2022 tax rates and stay informed of tax changes that may affect you. 7 hours ago2022 tax brackets for individuals.

The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up. The standard deduction is increasing to 27700 for married couples filing together.

Download the free 2022 tax bracket pdf. Tax brackets for income earned in 2022. 2021 federal income tax brackets for taxes due in April 2022 or in.

The 2022 and 2021 tax bracket ranges also differ depending on your filing status. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year. Each of the tax brackets income ranges jumped about 7 from last years numbers.

37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for. If you have questions you can. 5 hours agoThe Ascents best tax software for 2022 Our independent analysts pored over the perks and user reviews for the most popular tax provider services to land on the best-in-class.

1 day agoThe IRS will exempt up to 1292 million from the estate tax up from 1206 million for people who died in 2022 an increase of 71. 8 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000. The seven tax rates remain unchanged while the income limits have been adjusted for inflation.

11 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. 12 hours agoKey Points. The standard deduction increases to 27700 up 1800 from tax year 2022 the IRS.

A tax bracket is a range of incomes subject to a certain tax rate which is determined by your filing status and taxable. Federal Income Tax Brackets for 2022 Tax Season. Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals.

Heres a breakdown of last years income. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Federal Income Tax Brackets 2022.

The agency says that the Earned Income. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and. The IRS has released higher federal tax brackets for 2023 to adjust for inflation.

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million. Trending News IRS sets its new tax brackets.

Your tax bracket represents the highest tax rate youll pay on your income. 1 day agoForty-year high inflation has driven up the standard deduction for 2023 as well as the tax brackets earned income tax credit and more. 2023 Federal Income Tax Bracket s and Rates.

2022 tax brackets are here. 2 hours agoFor 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578125 693750 for married couples filing jointly. There are seven federal income tax rates in 2022.

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

Nyc Property Tax Rates For 2021 2022 Rosenberg Estis P C

2022 Income Tax Brackets And The New Ideal Income

Nyc Property Tax Rates For 2022 23 Rosenberg Estis P C

Germany Taxes Germany Income Tax Germany Tax Rates Germany Economy Germany Business For Enterpenures 2022

2022 2023 Tax Brackets Rates For Each Income Level

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

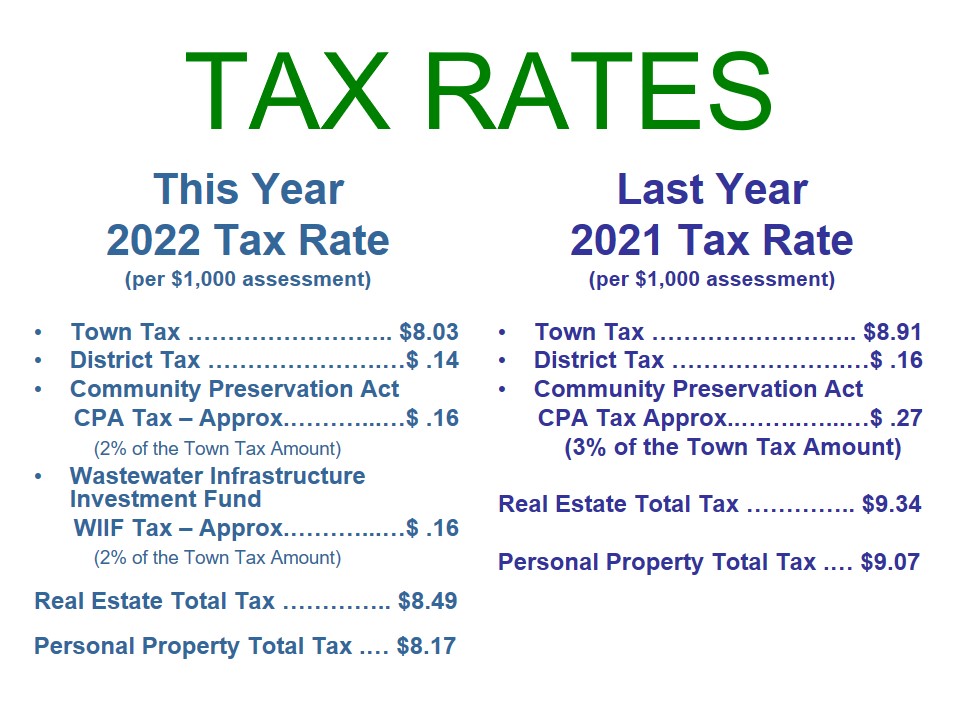

Fiscal Year 2022 Tax Rate Town Of Mashpee Ma

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Inflation Pushes Income Tax Brackets Higher For 2022

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

2022 Tax Brackets Internal Revenue Code Simplified

March 4 2022 2022 Small Business Tax Brackets Explained Gusto

Federal Income Tax Brackets For 2022 And 2023 The College Investor

Budget Highlights For 2021 22 Nexia Sab T

Tax Rate Changes Starting Now Initiative Chartered Accountants Financial Advisers